Wealth management services that go beyond buy and hold, includes retirement advice and dynamic investment portfolios carefully designed to reduce risk, improve returns, and create reliable income.

Wealth Management is our most comprehensive suite of services available and encompasses planning advice, implementation, and investment management.

Our advisory team starts with your personalized Retirement Analysis and thoroughly examines your financial life for planning opportunities. We then work with you to implement these strategies into your life, providing ongoing advice as your circumstances and goals evolve.

As a wealth management client you will get ongoing, comprehensive support for your financial life from a team of experts focused on your best interest. Our goal is to provide clarity and direction for your entire financial picture.

It all starts with your own Retirement Analysis!

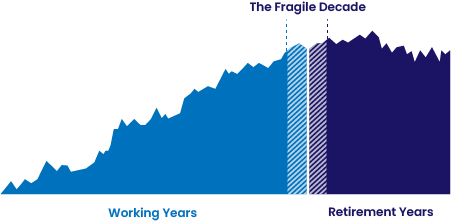

The transition from earning a paycheck to relying solely on retirement savings can be tricky. While markets typically grow over time, a severe bear market right before or after retirement could have a dramatic impact on your retirement spending.

This period, termed “the fragile decade,” is a critical time. If your plan is based solely on investments it may leave you unable to maintain your desired lifestyle or force you to delay retirement longer than you hoped. If you plan to retire early, this time period could be even longer. Our holistic wealth management approach helps safeguard against these risks.

The key is to align your essential spending with stable funding sources such as contractual income, portfolio distributions, and social security income. Our goal is to create a plan that will provide decades-long comfort for your family in retirement.

This analysis incorporates into your plan the effects inflation, sequence of returns risk (market risk), variable spending, taxes, and other factors specific to you. In addition, we will present recommendations for any retirement income solutions as a result of the income analysis.

We believe it’s critical to defend against the devastating impact large drawdowns can have on the long-term growth of an investment portfolio. We therefore develop and implement wealth management strategies specifically geared toward your unique goals.

Our investment approach seeks to preserve and grow wealth across market cycles. It focuses on strategies that manage risk, and attempts to limit large losses by utilizing strategies with low correlation to broader volatile market activity.

We combine strategies to help minimize downside risk. While each of our strategies has its own methodology, our main goal is to limit large-scale losses. For both performance & protection, we believe diversification across multiple strategies is critical to successful wealth management.

We take an objective approach to every strategy we recommend. We offer a diverse universe of investments to align with the individual situations of each investor. We take our role of fiduciary very seriously and always act in the best interests of our clients.

Tax management is an essential part of our planning, from minimizing tax-inefficient investments to actively offsetting gains and harvesting losses, we put tax considerations at the center of every plan. With tax laws constantly changing, we regularly review and adjust strategies to make sure we aren’t tipping the IRS.

Estate planning also works best when integrated with your broader wealth strategy. We collaborate with your team of advisors to ensure your estate is structured to fulfill your wishes.

Whether it’s optimizing employee benefits or planning long-term care, we’re here to help you navigate every financial aspect of your life.

It all starts with your Retirement Analysis!