Asset allocation is one of the most important ongoing investment decisions you’ll make, yet one that doesn’t get nearly enough attention. If you’re approaching retirement or already enjoying your post-career years, understanding how to properly distribute your investments across different asset classes can have an outsized impact on portfolio longevity (and your ability to sleep well at night!).

By: William Hinder, EA | March 3rd, 2025

Asset allocation refers to the strategic distribution of investments across different asset categories—primarily stocks, bonds, real estate, and cash equivalents—with the goal of balancing risk and reward according to your specific circumstances, time horizon, and financial objectives.

Asset allocation can account for a large amount of a portfolio’s performance variability over time. This can have a bigger impact than the investments you pick or market timing—areas that often receive much more attention from financial media and inexperienced investors alike.

For retirement-focused investors, proper asset allocation serves multiple crucial functions. It provides risk management through diversification across asset classes, which helps mitigate volatility and reduce the impact of significant market downturns. Strategic allocation also enables tax optimization by placing investments across taxable, tax-deferred, and tax-free accounts, which can substantially reduce lifetime tax liabilities.

Properly structured allocations can create sustainable income streams while preserving long-term growth potential—a critical balance for retirees facing potentially decades of retirement. For those with estate planning considerations, thoughtful asset allocation provides for efficient wealth transfer strategies that can preserve more assets for future generations.

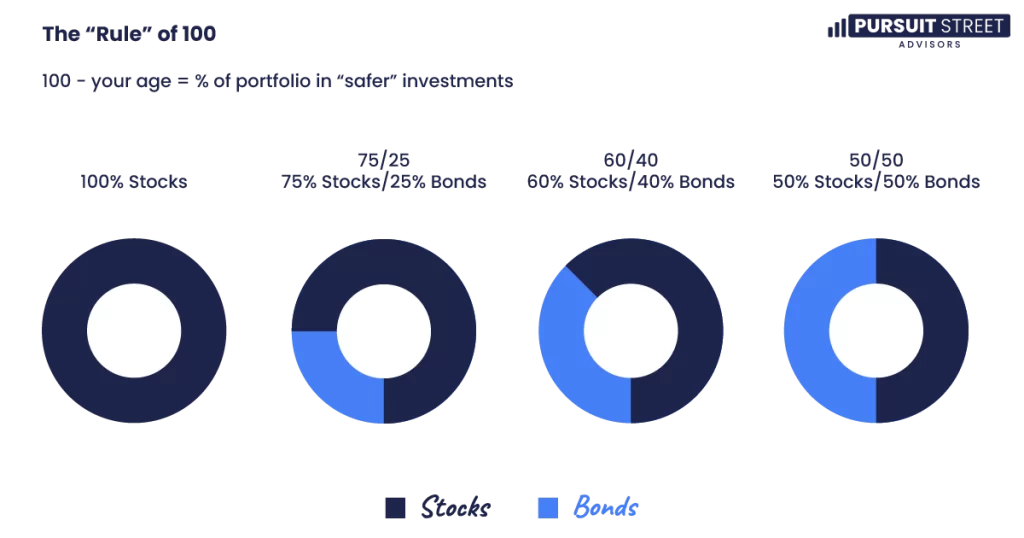

Conventional wisdom has long promoted age-based formulas such as the “100 minus your age” rule to determine optimal stock allocation. While these rules provide accessible starting points, they fail to account for the multifaceted nature of individual financial situations.

These traditional approaches fall short in several ways. First, they ignore individual circumstances. Two 65-year-old retirees may require dramatically different asset allocations based on portfolio size relative to income needs, additional income sources such as pensions or rental properties, healthcare considerations and family longevity, and desired legacy objectives.

Second, they fail to account for changing market dynamics. Modern retirement often spans 30+ years—a timeframe requiring continued growth that may not be achievable with overly conservative allocations. Historical bond returns that made conservative allocations viable in previous decades may not be replicated in today’s interest rate environment.

Third, they neglect tax implications. Asset allocation decisions that ignore tax consequences can significantly reduce effective returns. The location of assets across account types (taxable, tax-deferred, tax-free) can be as important as the selection of the assets themselves.

Rather than relying on oversimplified rules, a more sophisticated approach considers how allocation should evolve throughout an investor’s financial lifecycle, with particular attention to tax implications and changing risk profiles.

During this early career stage, investors typically have minimal accumulated assets but maximum time horizons. At this point time is your greatest asset. While conventional wisdom correctly suggests aggressive allocations heavily weighted toward equities, additional nuances deserve consideration.

The optimal allocation strategy during these foundation years generally includes 90-100% equities with broad diversification across domestic, international, and emerging markets. Fixed income investments serve primarily for emergency reserves rather than long-term investment purposes. Regular investment contributions take priority over precise allocation concerns, as the habit of consistent investing will ultimately prove more valuable than perfect optimization at this stage.

From a tax planning perspective, these years present unique opportunities. Maximizing Roth IRA/401(k) contributions while in lower tax brackets establishes tax-free growth potential that can compound for decades. Establishing tax-efficient investment habits early through index funds and ETFs in taxable accounts lays groundwork for future tax management. Additionally, understanding the principles of tax-loss harvesting prepares investors for more sophisticated implementation as assets grow.

The key implementation focus during this phase should be on automation of investment contributions to enforce discipline, education regarding market volatility to develop psychological resilience, and experimentation with different asset classes to determine genuine risk tolerance under real market conditions.

Life gets more complicated during these decades. Your career is advancing, but so are your responsibilities – perhaps a mortgage, children, and countless competing financial priorities.

The optimal allocation strategy during this phase typically involves 70-85% equity allocation, potentially decreasing as portfolio values increase. This period often marks the introduction of dedicated fixed income components comprising 10-20% of portfolios. Qualified investors may begin considering alternative investments to further diversify return streams. Many investors benefit from creating segregated portfolios for different time horizons and objectives during these years.

Tax planning considerations become more sophisticated during this phase. Investors should maintain a strategic balance between traditional and Roth retirement contributions based on current and projected future tax situations. Implementation of tax-loss harvesting strategies in taxable accounts can begin in earnest as portfolio values grow. Asset location principles gain importance as portfolio complexity increases, with consideration given to which investments belong in which account types. For charitably inclined investors, this period may introduce appreciated securities donation strategies.

The key implementation focus should center on establishing regular rebalancing discipline as portfolio values increase, integrating employer equity compensation into the overall allocation strategy, and developing investment policy statements to guide decision-making through market volatility.

Your 50s typically represent your peak earning years and your last major opportunity to shore up retirement savings. The allocation decisions you make during this decade can significantly impact your retirement security.

The optimal allocation strategy typically includes a gradual reduction in equity exposure to approximately 60-75% depending on individual circumstances. Fixed income allocations increase with diversification across duration and credit quality to manage interest rate and default risks. Some investors may consider introducing annuity products for guaranteed income components, particularly if pension benefits are limited. This decade marks the important transition from pure accumulation thinking toward integration of retirement income planning into allocation decisions.

Tax planning takes center stage during this critical period. Investors should maximize catch-up contributions in tax-advantaged accounts to accelerate late-stage savings. Evaluation of tax-efficient withdrawal sequencing strategies begins as retirement approaches. For many, strategic Roth conversion analysis in favorable tax years can optimize lifetime tax efficiency. Implementation of comprehensive asset location frameworks becomes increasingly valuable as portfolio values peak.

The key implementation focus shifts toward stress-testing portfolios against sequence-of-returns risk scenarios, aligning allocation with specific retirement income strategies, reducing unnecessary portfolio complexity, and enhancing focus on risk management as portfolio values reach their highest points.

As retirement approaches, your allocation strategy needs to shift from pure accumulation to preparing for distributions while maintaining enough growth for what could be a 30+ year retirement.

The optimal allocation strategy requires careful calibration of equity exposure based on withdrawal needs and portfolio sufficiency. Implementation of liability-matching strategies for essential expenses provides security regardless of market conditions. Development of liquidity buffers helps mitigate sequence-of-returns risk during the vulnerable early retirement years. Integration of Social Security claiming strategies with portfolio decisions ensures optimal coordination of income sources.

Tax planning considerations reach their most complex stage during this transition. Detailed multi-year tax projection planning becomes essential for optimizing the transition to retirement. Strategic partial Roth conversions can significantly improve lifetime tax efficiency, particularly before RMDs begin. Planning for RMD implications and tax bracket management takes on increased importance. Charitable strategies may help minimize taxation on concentrated positions accumulated over a career.

The key implementation focus should center on creating withdrawal policies and spending guidelines, refining estate planning strategies, assessing long-term care funding alternatives, and developing contingency plans for potential market disruptions during the critical early retirement years.

During retirement, your asset allocation requires ongoing refinement to balance longevity risk against immediate income needs while staying tax-efficient.

The optimal allocation strategy becomes highly personalized based on withdrawal rate relative to portfolio value, additional income sources and their reliability, legacy objectives and charitable intentions, and individual risk tolerance and behavioral tendencies. Strategic cash reserves for near-term spending needs provide insulation from market volatility. Income-generating allocations should align with specific tax circumstances to optimize after-tax returns.

Tax planning remains paramount throughout retirement. Tax-efficient withdrawal sequencing across account types can significantly extend portfolio longevity. Strategic Roth conversions in lower-income years continue to offer tax optimization opportunities. Qualified Charitable Distribution strategies provide efficient RMD management for philanthropically minded retirees. Tax-aware legacy planning ensures efficient transfer of inherited assets.

The key implementation focus shifts toward regular reassessment of sustainable withdrawal rates, dynamic allocation adjustments based on changing market conditions, integration of healthcare considerations into ongoing planning, and gradual simplification of portfolio structure for future management.

Beyond theoretical understanding, effective asset allocation requires systematic implementation. The following five-step process provides a structured approach for developing and maintaining an optimal allocation strategy.

Before determining appropriate asset allocation, conduct a thorough evaluation of your complete financial situation. This includes inventorying all investment accounts, real estate holdings, business interests, and other assets. Assess the reliability and tax implications of all current and future income streams. Analyze outstanding debts, future obligations, and potential contingent liabilities. Evaluate current and projected future tax brackets to identify planning opportunities. Finally, clarify wealth transfer objectives and charitable goals that may influence allocation decisions.

Determine appropriate risk parameters through assessment of multiple factors. Quantify your risk capacity—your ability to withstand market volatility based on time horizon and resource sufficiency. Evaluate your risk tolerance by honestly assessing your psychological comfort with investment fluctuations under various scenarios. Calculate your risk requirement—the minimum return needed to achieve your financial objectives. Then use these factors to determine optimal risk parameters that balance income needs with behavioral realities.

Design a comprehensive allocation framework addressing both asset class selection and account location considerations. Begin with determining appropriate investment categories based on risk/return characteristics aligned with your established parameters. Within major categories, establish sub-allocations such as the balance between domestic and international equities. Optimize placement of investments across taxable, tax-deferred, and tax-free accounts to enhance after-tax returns. Finally, develop a systematic approach for generating portfolio income that aligns with your tax situation and spending needs.

Execute your allocation strategy with careful attention to tax and cost efficiency considerations. Start by analyzing existing positions for tax implications and transition considerations. Develop a phased approach for implementing significant allocation changes to minimize market timing risks. Utilize tax-loss harvesting, charitable strategies, and strategic rebalancing to execute transitions tax-efficiently. Throughout implementation, select appropriate investment vehicles with careful attention to expense ratios and transaction costs to maximize net returns.

Establish systematic processes for maintaining your allocation while adapting to changing circumstances. Define specific triggers and methodologies for portfolio rebalancing rather than relying solely on calendar-based approaches. Establish consistent intervals for comprehensive portfolio assessment to ensure ongoing alignment with objectives. Identify specific life circumstances requiring allocation reconsideration such as inheritance, career changes, or health developments. Maintain detailed records of allocation decisions and rationales to provide context for future adjustments.

For investors focused on tax efficiency (which describes most of our clients), several advanced strategies deserve consideration. To read our article on lowering taxes in retirement CLICK HERE.

Strategic placement of investments across account types can boost annual after-tax returns without increasing portfolio risk. This approach involves placing tax-inefficient investments such as taxable bonds, REITs, and actively-managed funds with high turnover in tax-advantaged accounts where their income is sheltered from immediate taxation. Tax-efficient investments like municipal bonds, low-turnover index funds, and qualified dividend-paying stocks are held primarily in taxable accounts where their favorable tax treatment can be fully utilized. High-growth assets with the greatest appreciation potential often belong in Roth accounts to maximize tax-free growth opportunities.

Systematic tax-loss harvesting within the taxable portion of portfolios can significantly enhance after-tax returns while maintaining allocation integrity. Effective implementation involves establishing “harvesting pairs” of similar but not substantially identical investments that can be exchanged while maintaining market exposure. Regular monitoring identifies harvesting opportunities, particularly during market declines. Coordination with rebalancing requirements ensures that tax management and allocation maintenance work in concert rather than conflict. Your custodian should provide detailed record-keeping and necessary documentation for tax reporting and basis tracking.

For retirement-focused investors, integrating Roth conversion strategies with asset allocation decisions can optimize lifetime tax efficiency. Consider converting specific asset classes during market downturns to maximize conversion value—effectively “buying the dip” with tax benefits. Implement annual conversion schedules aligned with tax bracket management to fill lower brackets without pushing into higher ones. Develop conversion timelines coordinated with RMD planning to minimize forced distributions and resulting higher taxes.

Rather than static withdrawal hierarchies, sophisticated investors implement dynamic withdrawal strategies based on changing circumstances. Current and projected tax brackets influence which accounts to draw from in a given year. Market conditions and relative asset valuations may suggest harvesting from overweight positions. Required Minimum Distribution obligations create forced withdrawal considerations that must be integrated into the overall strategy. Charitable intent and legacy planning objectives influence which assets are preserved for wealth transfer and which are optimized for lifetime spending.

The most important thing to understand about asset allocation is that it must be personalized to your unique situation. Generic formulas provide useful starting points, but they can’t account for the complexity of your individual financial circumstances.

For investors approaching or already in retirement, working with qualified advisors to develop truly customized allocation strategies often proves invaluable. The potential improvement in risk-adjusted returns, tax efficiency, and retirement security typically outweighs the associated costs many times over.

The fundamental principle remains: Your asset allocation should serve your life goals, not the other way around. By tailoring your asset allocation to your specific needs, risk tolerance, and tax situation, you can develop an approach that truly supports your vision for retirement.

Our Retirement Analysis provides an in-depth look into your asset allocation as well as asset location in your current portfolio. In addition to this we provide answers to your most pressing retirement questions like, “Can I afford to retire?”, “Can I reduce taxes?”, “Can I invest smarter?”, and “Will I run out of money?”, get started by clicking the big blue button below!